how much does a property tax lawyer cost

You might also expect that lawyers charge higher rates as they gain more experience. How much does a probate lawyer cost in Texas.

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

For instance most tax attorneys bill 200 to 400 per hour.

.png)

. The cost of hiring a lawyer for a property tax appeal will vary depending on the lawyers experience the complexity of your case and the amount of money at stake. Nov 6 2019 on. Mr Hunt said the 2000 tax-free amount for dividends will fall to 1000 in April 2023 and then halve again to 500 in April 2024.

How Much Does a Probate Lawyer Cost in Texas. How much does a property tax lawyer cost. As an example of the varying rates you may pay.

Trial Cases Can Run 5000-15000. Hourly rate or retainer. Every attorney will charge a different hourly rate but most rates are.

The average closing costs for a seller total roughly 8 to 10 of the sale price of the home or about 19000-24000 based on the median US. Home value of 244000 as of December. An hourly rate is a common way to bill for many types of cases including tax cases.

Heres a very simple breakdown of the average prices that tax attorneys charge for common tax services whether hourly or as a flat. The tax rates remain unchanged and basic. Fees for fertile and sterile animals are 30 and 10 respectively for a one-year license according to CMPD.

A lawyer often charges between 100 and 400 per hour for. As an example of the different rates you can. Our study bore out that expectation with average minimum and maximum rates climbing from 235 and.

The cost of a probate lawyer varies depending on the complexity of the estate and the lawyers experience. Examples of these are corporate tax issues income tax issues international tax issues property tax and tax evasion. For example most tax attorneys have a bill of 200 to 400 per hour.

Some attorneys charge set fees for certain tax services and others charge an hourly rate charging the client a retainer based on that rate to start. Here our attorneys tell you what you need to know. This is because taxes are involved in almost every.

Attorney Cost for Real Estate Litigation. Attorney fees for real estate litigation generally. License costs vary depending on whether your pet is sterilized.

How Much Does a Tax Attorney Cost. That said sometimes a real estate attorney is in the best position to evaluate tax consequences. Thus an attorney can cost anywhere from 200 to 2000 dollars depending on the circumstances.

Typical Cost of Hiring a Tax Attorney. If an attorney charges a flat fee it will generally be around 1000 to 4000. Then the complexity of your case may help determine the rates.

The complexity of your case can determine the rates. Some of the most respected and experienced attorneys may set hourly rates at 1000 per hour or. This also may vary depending on whether or not the cost includes the.

For many other sorts of cases particularly tax issues an hourly fee is a typical approach to charge. Speak to an Attorney Now. If an attorney charges a flat fee it will generally be around 1000 to 4000.

Every attorney will charge a different hourly rate but most rates are. The average hourly cost for the services of a lawyer ranges from 100 to 400 per. Every tax attorney has a different rate but expect it to range from 200 to 400 per hour.

How much does a property tax lawyer cost.

How Can You Object To Your Property Tax Assessments In Milwaukee And Wisconsin Milwaukee Wi Real Estate Lawyer

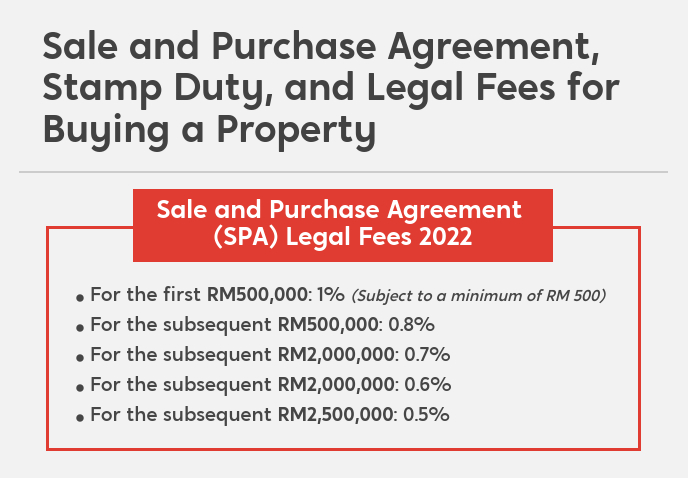

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Real Estate Lawyer Fees Ontario 450 Best Reviews Online Quote

Hecht Group Appealing Your Property Taxes How Much Does It Cost To Hire A Lawyer

What Type Of Lawyers Make The Most Money Lawrina

How Much Does A Tax Attorney Cost Cross Law Group

2022 Average Real Estate Lawyer Fees With Price Factors

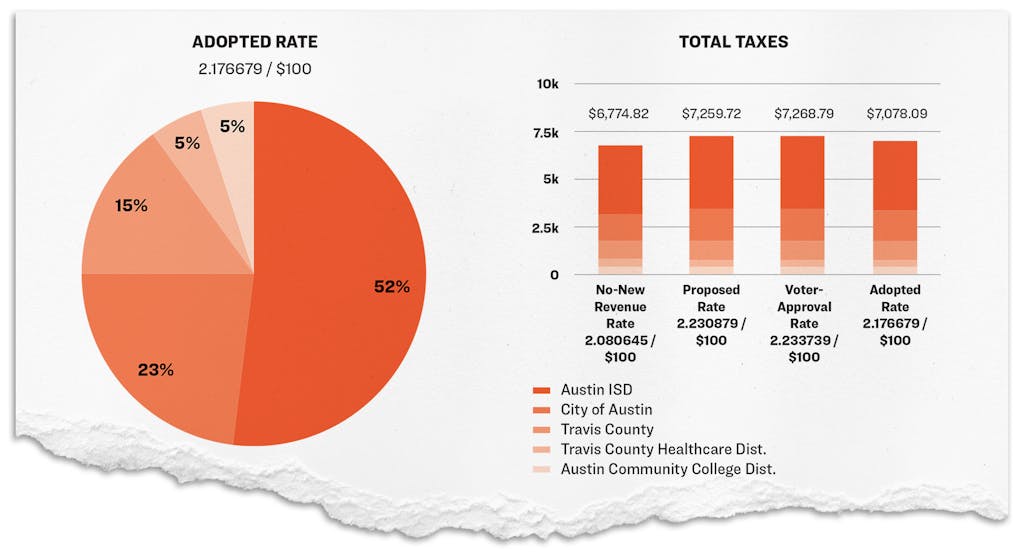

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Real Estate 101 The Cost Of Transferring A Land Title In The Philippines Philrep Realty Corporation

Albany Golf Course Taxes Lawyer E Stewart Jones Hacker Murphy

Michigan Property Tax Appeals Lawyer Commercial And Industrial Properties

Do You Need A Property Tax Attorney Or Consultant Propertytaxes Law

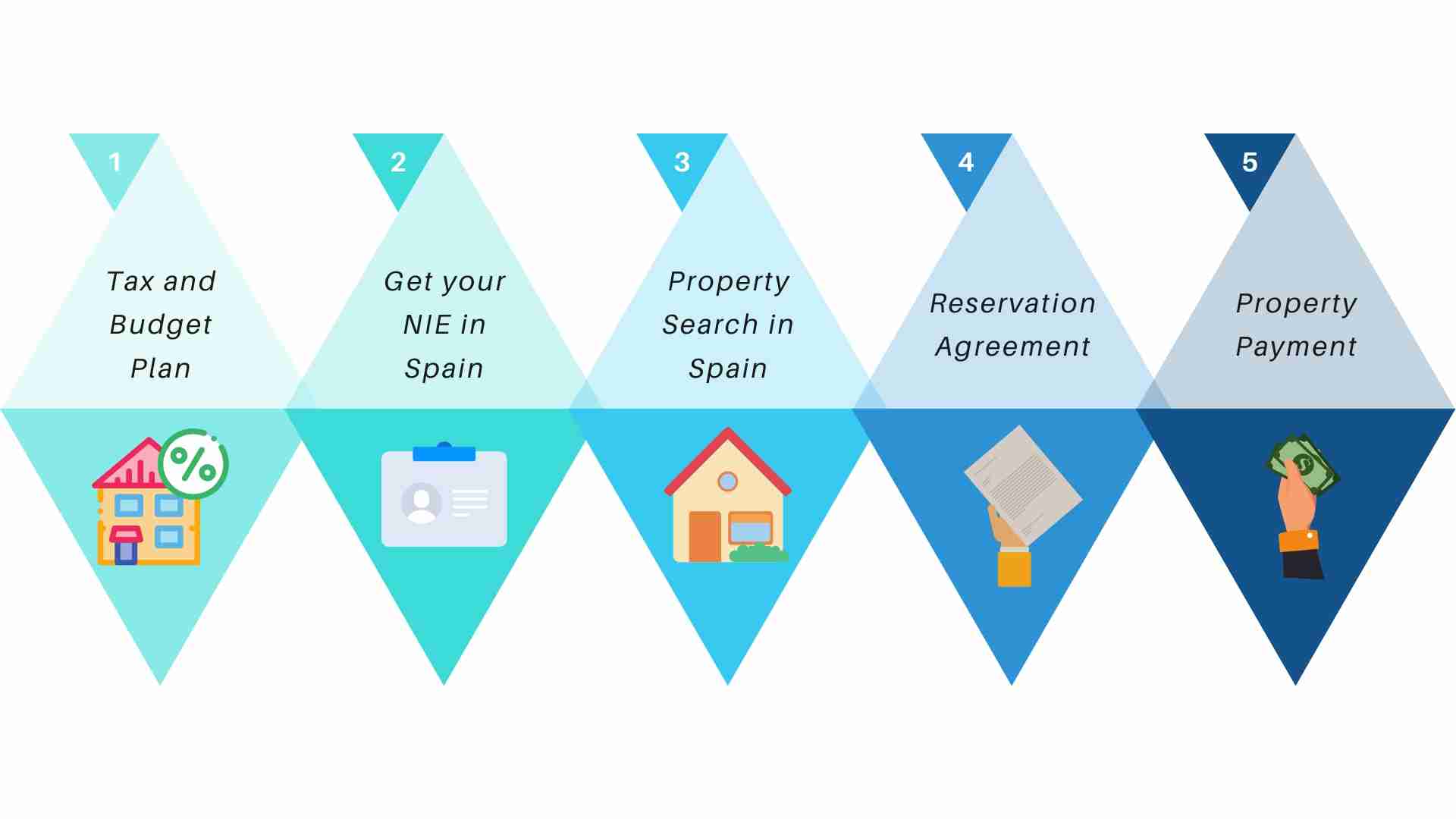

Buying A House In Spain 2022 Requirements Process Costs

The Connection Between Commercial Property Tax Assessments And Purchase Prices New Jersey Law Firm New Jersey Attorneys Lawyers

Your Assessment Notice And Tax Bill Cook County Assessor S Office

How Much Do Lawyers Cost Rocket Lawyer

Property Taxes And Your Mortgage What You Need To Know Ramsey